Whether new to the property market or a seasoned professional, prospective buyers need to consider a few factors when purchasing a property and working on getting a home loan, including property valuations.

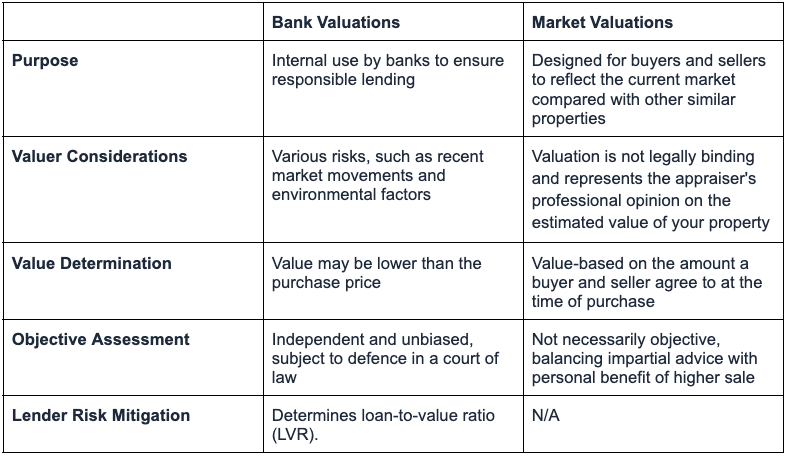

It’s important to note that bank valuations for a property are not the same as market valuations or sale prices. Learn about the different types of property valuations and considerations throughout the home buying process.

Bank valuations vs market valuations

Market valuation: The amount a property would sell for on the open market at a particular point in time, dependent on the amount a buyer and seller would agree to at the time of purchase.

Bank valuation: The value of the property, as determined by the lender, used to mitigate risk and ensure coverage from financial impacts should the property be forcibly sold.

Bank valuations determine the loan-to-value ratio (LVR), affecting the amount to borrow. A higher LVR means borrowing more of a home’s value, which could make buyers vulnerable to increasing interest rates as the bank offsets perceived risk.

Understanding bank valuations

The process of a bank valuation typically involves a few key steps.

- Physical Inspection: The appraiser or valuer will physically inspect the property to assess its condition, size, and layout. They will also take note of any relevant features, such as the property’s location or proximity to amenities. Other areas of consideration include council zoning, planning and restrictions, fixtures and fittings, vehicle access (driveways, garage, carport), and building structure.

- Market Research: The appraiser will research the local property market to determine the current market demand and supply for properties similar to the one being valued. They will also consider any recent sales or transactions of similar properties in the area to determine the current market value.

- Report Generation: The appraiser will use the information gathered from the physical inspection and market research to generate a report that estimates the property’s current market value. The bank or financial institution will use this report to determine the borrower’s loan amount and interest rate.

Preparing for property valuations

Presentation is key for property valuation as it can affect the perceived value of a property. A well-presented property is likely to be valued higher than a poorly presented one. Simple improvements such as cleaning, decluttering, and landscaping can significantly impact the property’s value. Additionally, renovations such as kitchen upgrades or adding an extra bedroom can increase the property’s value, but the cost of the renovation should be considered against the expected increase in value.

It’s important to understand the nuances of property valuations and seek professional advice to ensure you’re making an informed decision.

Work with ALC

As dedicated property aggregators, we understand the importance of the steps within the property purchase process – that’s why we offer a range of home and land packages across our vast network of developers and builders, removing the complexity in sourcing and delivering new homes on demand.

If you have a client ready to build or expand their property portfolio, reach out to our team to learn more about our offerings and how we can provide a property that matches the criteria!